Want to observe a rapid jump in your credit score? It's manageable with the right tactics. First, analyze your credit file for any errors. Challenge any concerns you identify to ensure accuracy. Next, prioritize on settling your bills promptly each month. A pattern of consistent remittance demonstrates responsibility to institutions.

- Moreover, maintain a reasonable credit ratio. Target to use less than one-third of your available limit.

- Consider obtaining a credit loan if you have little credit history. This can help develop your creditworthiness.

Keep in mind that building credit is a long-term process. Persistence is key! How to Improve Your Credit Score Fast

Supercharge Your Credit: A Rapid Improvement Guide

Ready to maximize your credit score and unlock a world of financial benefits? A strong credit history is the key to securing favorable interest rates, receiving loans with ease, and even attracting potential landlords. This guide will empower you with the tools to swiftly improve your credit standing and achieve your financial goals.

- Implement proven credit-building methods.

- Review your credit report regularly for errors or inconsistencies.

- Build a responsible payment history by paying bills on time, every time.

- Reduce your credit utilization ratio to keep your credit card balances in check.

By adhering these effective steps, you can supercharge your credit and pave the way for a brighter financial future.

Elevate High Scores: How to Improve Your Credit Fast

Want to crushing your credit score goals? It's easier than you think! Here are some proven strategies to rapidly boost your score:

* **Settle your bills on time.** This is the most important factor in your credit score.

* **Keep your credit utilization low.** Aim to use less than 40% of your available credit.

* **Check your credit report regularly for errors.** You can get a free copy from each of the three major credit bureaus every quarter.

* **Build a healthy mix of credit.** Having a variety of credit accounts, such as lines of credit, can help improve your score.

Don't let a low credit score restrict you back. Take action today and see your score increase!

Rebuild Your Credit Fast : Your Path to Financial Security

Are you struggling with a damaged credit score? Don't stress! Repairing your credit is within reach. Our proven strategies can help you on a rapid path to financial freedom. We'll analyze your current credit standing, highlight the challenges, and design a tailored plan to improve your score. With consistent effort, you can unlock financial independence. Let us show you the way to a brighter financial future!

- Pay down your debt

- Review your credit score regularly

- Get a secured credit card

Boost Your Credit Score in Just 7 Days!

Want to observe your credit score climb faster than ever before? Our comprehensive 7-Day Credit Score Challenge is crafted to provide real, tangible results in just a week.

Join us and discover the secrets to repairing your credit swiftly. You'll be amazed by how much you can achieve in just 7 days!

This isn't a idea; it's a proven system that utilizes the latest credit-building techniques.

Ready to upgrade your financial future?

Begin your journey today!

Get started now and unlock the power of a higher credit score.

Fast Credit Repair: Proven Strategies for a Higher Score

Boosting your credit score can seem like a daunting task, but with the proper strategies, you can achieve a higher score in no time. Start by reviewing your credit report for any mistakes. Dispute any incorrect items with the credit bureaus and settle all your payments on time. Think about a secured credit card to build your standing, and steer clear of opening new accounts too frequently.

- Consistently monitor your credit report for changes.

- Maintain a low credit utilization ratio.

- Develop a positive payment history.

Remember that credit repair is a long-term process. Be patient and follow these strategies for the best achievements.

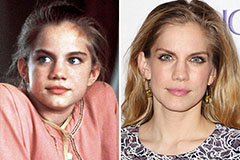

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!